Page 90 from: Recycling International May/June issue

90

MARKET ANALYSIS

benefits and the ability to meet the

high-performance demands of mod-

ern automotive production’.

GREEN AND CLEAN

Chinese researchers are claiming a

recovery rate of 99.99% from lithium

recycled from spent lithium-ion bat-

teries using a fast process which elim-

inates the use of harsh chemicals.

They are also claiming rates of

96.86% for nickel, 92.35% for cobalt

and 90.59 % for manganese.

The work of 10 academics from

Central South University, Changsha

and other institutions is reported in

the journal of the German Chemical

Society. The process, called ‘neutral

leaching’, needs just 15 minutes in

laboratory tests to separate out the

desired battery materials. The new

technology and its speed are seen as

big improvements on traditional acid

or/and ammonia leaching techniques.

‘Neutral leaching has been pioneer-

ingly proposed to achieve a low-cost

and harmless hydrometallurgical pro-

cess,’ their report says. ‘It is sturdily

confirmed that the intractable prob-

lem, that effective extraction is avail-

able only under the aggressive acid/

alkali-ion conditions, is well-solved

within a mild leaching atmosphere.

‘This green and efficient strategy in

neutral solution environment opens a

new pathway to realise the large-

scale pollution-free recycling of spent

batteries.’

ALUMINIUM

At the end of March, high-grade alu-

minum (three-month quotation) was

quoted on the LME at US$ 2 540.50

per tonne, lower than four weeks ear-

lier. Aluminum alloy, on the other

hand, rose noticeably from US$ 2 225

at the end of February to US$ 2 559,

perhaps a sign that scrap remains

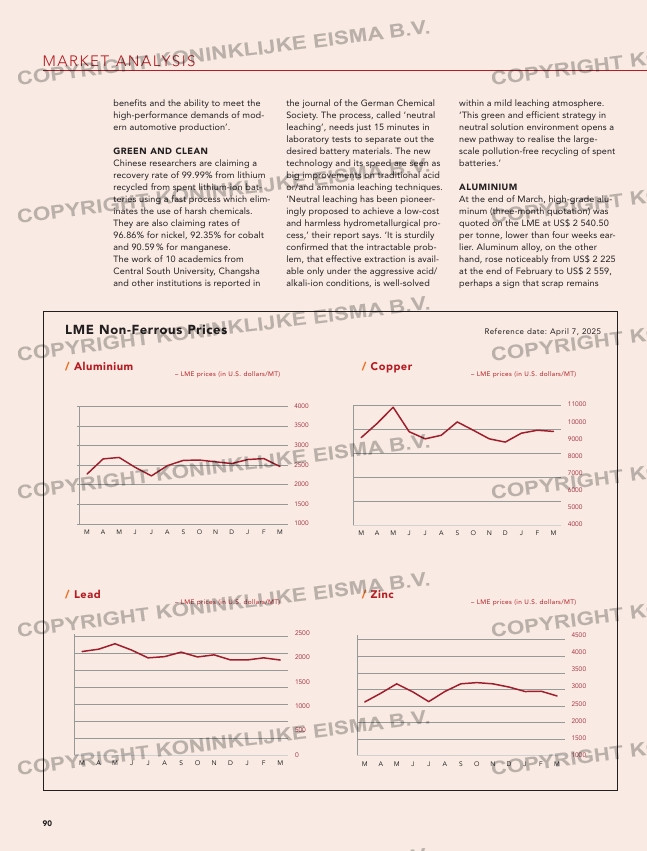

LME Non-Ferrous Prices Reference date: April 7, 2025

/ Aluminium / Copper

– LME prices (in U.S. dollars/MT) – LME prices (in U.S. dollars/MT)

/ Lead / Zinc

– LME prices (in U.S. dollars/MT) – LME prices (in U.S. dollars/MT)

M A M J J A S O N D J F M

2274 2660 2694 2444 2224 2485 2623 2630 2582 2540 2644 2662 2464

1000

1500

2000

2500

3000

3500

4000

0

1000

2000

3000

4000

5000

6000

M A M J J A S O N D J F M

M A M J J A S O N D J F M

9072 9905 10856 9418 9014 9214 9995 9505 9015 8821 9334 9510 9441

4000

5000

6000

7000

8000

9000

10000

11000

0

100

200

300

400

500

M A M J J A S O N D J F M

M A M J J A S O N D J F M

2130 2178 2290 2159 2000 2026 2116 2017 2060 1956 1959 2002 1955

0

500

1000

1500

2000

2500

0

70

140

210

280

350

420

490

M A M J J A S O N D J F M

M A M J J A S O N D J F M

2561 2814 3092 2860 2570 2862 3086 3125 3088 2994 2867 2874 2737

1000

1500

2000

2500

3000

3500

4000

4500

100

500

900

1300

1700

2100

2500

2900

M A M J J A S O N D J F M

scarce and expensive. Visible stocks

in the LME’s licensed warehouses

continued to decline, recently stand-

ing at just 466 050 tonnes for high-

grade and 1 560 tonnes for alloy.

Scrap prices remained high overall

and rose sharply in some cases.

Extrusion scrap was a US$ 2 596, new

low-copper aluminum cost US$ 2 050

and pure wire scrap traded at around

US$ 2 600.

COPPER

The red metal had broken through

the US$ 10 000 per tonne mark in

recent weeks but then declined

slightly. Nevertheless, it remains at

elevated levels. Grade A copper was

recently quoted in London at US$

9,720. Visible stocks in LME ware-

houses stood at 212 925 tonnes.

As in previous weeks, scrap prices

were aligned with the fixed LME pric-

es and remained high. A sharp

increase in copper exports to the US

88-89-90-91_manonferrous12adv.indd 90 10-04-2025 16:17