Page 84 from: Recycling International May/June issue

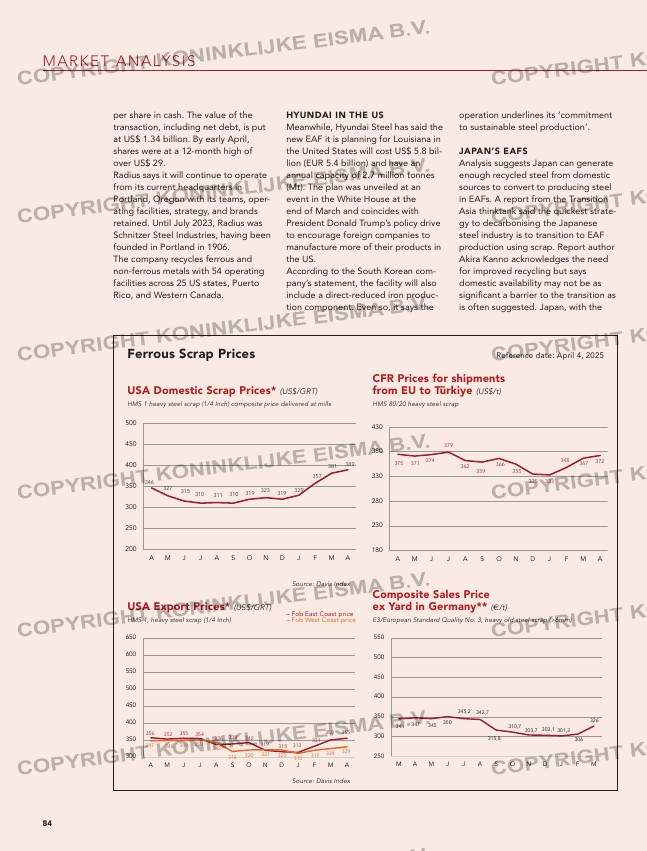

Ferrous Scrap Prices Reference date: April 4, 2025

USA Domestic Scrap Prices* (US$/GRT)

HMS 1 heavy steel scrap (1/4 Inch) composite price delivered at mills

Source: Davis Index

Source: Davis Index

USA Export Prices* (US$/GRT)

HMS 1, heavy steel scrap (1/4 Inch)

Composite Sales Price

ex Yard in Germany** (€/t)

E3/European Standard Quality No. 3, heavy old steel scrap (>6mm)

CFR Prices for shipments

from EU to Türkiye (US$/t)

HMS 80/20 heavy steel scrap

– Fob East Coast price

– Fob West Coast price

A M J J A S O N D J F M A

346 327 315 310 311 310 319 323 319 329 357 381 389

346

327

315

310 311 310 319

323

319

329

357

381 389

200

250

300

350

400

450

500

A M J J A S O N D J F M A

A M J J A S O N D J F M A

356 352 355 354 336 338 342 319 315 313 331 350 355

347 348 349 350 342 316 320 321 320 310 319 324 329

356 352 355 354

336 338 342

319 315 313

331

350 355

347 348 349 350 342

316 320

321 320 310

319 324

329

300

350

400

450

500

550

600

650

A M J J A S O N D J F M A

A M J J A S O N D J F M A

375 371 374 379 362 359 366 355 335 333 348 367 372

375 371

374

379

362

359

366

355

335 333

348 367 372

180

230

280

330

380

430

A M J J A S O N D J F M A

M A M J J A S O N D J F M

344 347 345 350 345,2 342,7 315,8 310,7 303,7 303,1 301,2 306 326

344 347 345

350

345,2 342,7

315,8

310,7

303,7 303,1 301,2

306

326

250

300

350

400

450

500

550

M A M J J A S O N D J F M

per share in cash. The value of the

transaction, including net debt, is put

at US$ 1.34 billion. By early April,

shares were at a 12-month high of

over US$ 29.

Radius says it will continue to operate

from its current headquarters in

Portland, Oregon with its teams, oper-

ating facilities, strategy, and brands

retained. Until July 2023, Radius was

Schnitzer Steel Industries, having been

founded in Portland in 1906.

The company recycles ferrous and

non-ferrous metals with 54 operating

facilities across 25 US states, Puerto

Rico, and Western Canada.

operation underlines its ‘commitment

to sustainable steel production’.

JAPAN’S EAFS

Analysis suggests Japan can generate

enough recycled steel from domestic

sources to convert to producing steel

in EAFs. A report from the Transition

Asia thinktank said the quickest strate-

gy to decarbonising the Japanese

steel industry is to transition to EAF

production using scrap. Report author

Akira Kanno acknowledges the need

for improved recycling but says

domestic availability may not be as

significant a barrier to the transition as

is often suggested. Japan, with the

MARKET ANALYSIS

84

HYUNDAI IN THE US

Meanwhile, Hyundai Steel has said the

new EAF it is planning for Louisiana in

the United States will cost US$ 5.8 bil-

lion (EUR 5.4 billion) and have an

annual capacity of 2.7 million tonnes

(Mt). The plan was unveiled at an

event in the White House at the

end of March and coincides with

President Donald Trump’s policy drive

to encourage foreign companies to

manufacture more of their products in

the US.

According to the South Korean com-

pany’s statement, the facility will also

include a direct-reduced iron produc-

tion component. Even so, it says the

highest steel stock per capita and a

net scrap steel exporter, does not

have a shortage of scrap. However,

Kanno notes the key obstacle for

decarbonising Japan’s EAF fleet

remains access to cost competitive

and predictable zero-carbon, renew-

able electricity. The Japan Iron and

Steel Federation has set a target of

increasing domestic scrap circulation

by around 6.9 million tonnes by 2030.

LOWER RATES

A brighter note for the sector has

been a decline in shipping rates.

Xeneta reports that average spot rates

from Far East to North Europe were

around US$ 2 545 per FEU (40ft equiv-

alent container), the lowest level since

the end of 2023. Rates from the Far

East to the Mediterranean spot rates

have not declined as far but have

halved from a peak in July. Xeneta

says carriers sought to push up rates

82-83-84-85_maferrous.indd 84 10-04-2025 14:42