Page 47 from: Recycling International Jan/Feb 2025

NICKEL & STAINLESS

media reports suggesting the

Indonesian government could reduce

nickel mine quotas below the 272 mil-

lion tonnes permitted for 2025.

Although these have not yet been

confirmed, the country is said to be

seeking to preserve its resources and

enforce environmental standards.

Macquarie has said that, although

unlikely, potential cuts of up to a third

of global supply could result in an

upward price risk, and it continues to

see the market in a small oversupply

this year.

Trump’s return to power is likely to

cause uncertainty globally amid his

threatened tariffs. These taxes could

also impact neighbouring Canada’s

nickel industry, which is a large suppli-

er to the country. Meanwhile in the US

itself, some are expecting increased

production at sites where permits have

previously been denied, with the

President already issuing executive

orders rolling back environmental pro-

tections for mining, oil and gas.

PROFITS DOWN

The weakness of the stainless steel

market was seen in Outukumpu’s

profit warning in December, which

expects its Q4-adjusted Ebitda to be

lower than Q3 due to the market con-

ditions in Europe, extended mainte-

nance in Finland and a negative

inventory value impact. Aperam also

gave an update in January ahead of

its February earnings to say that vol-

umes in Europe remain at a

depressed level and pricing pressure

intensified in December.

Meanwhile, China has reported an

increase in both stainless steel pro-

duction and consumption for 2024.

Output reached 39.4 million tonnes in

the year, while consumption stood at

32.5 million tonnes.

Many will be watching China this year

for any additional stimulus that will

support its economy, especially con-

struction and consumer spending.

GREEN DRIVE

Momentum for greener product offer-

ings grew during 2024, and is likely to

continue in 2025, with Outokumpu

announcing an expansion to its Circle

Green offering. It said these products

had seen uptake by 30 companies,

accounting for 50 400 tonnes of

reduced emissions. The company also

recently invested EUR 40 million in a

biocarbon plant in Germany to further

reduce emissions and says it can

reduce 50% of its direct emissions

with biocoke.

Additionally, it has also recently pub-

lished externally verified new environ-

mental product declarations. The

company joins other producers in the

sector who continue to increase their

47recyclinginternational.com | January/February | 2025

offering of them, including Aperam

and Acerinox, seeking to meet rising

customer demands for environmental

data.

Meanwhile, Swiss Steel Group

announced in January it would supply

SKF its GreenSteel Climate+ brand of

bars and wires, which are produced

using steel scrap.

During 2025, the recycling of stainless

steel scrap will remain popular with

producers seeking to reduce emis-

sions, pairing this with renewable

electricity. Even so, pricing was under

pressure in 2024 due to alternative

feedstocks such as nickel pig iron.

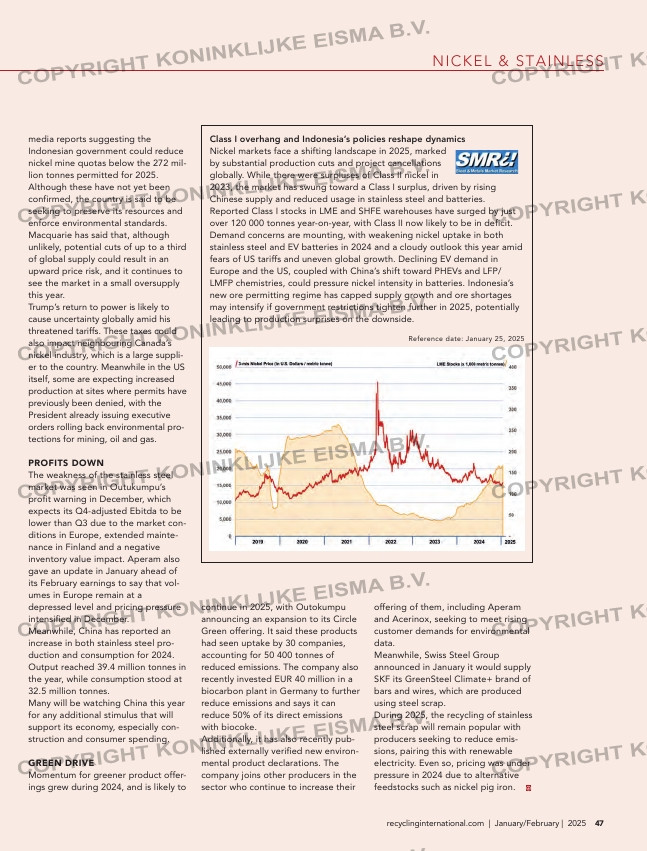

Class I overhang and Indonesia’s policies reshape dynamics

Nickel markets face a shifting landscape in 2025, marked

by substantial production cuts and project cancellations

globally. While there were surpluses of Class II nickel in

2023, the market has swung toward a Class I surplus, driven by rising

Chinese supply and reduced usage in stainless steel and batteries.

Reported Class I stocks in LME and SHFE warehouses have surged by just

over 120 000 tonnes year-on-year, with Class II now likely to be in deficit.

Demand concerns are mounting, with weakening nickel uptake in both

stainless steel and EV batteries in 2024 and a cloudy outlook this year amid

fears of US tariffs and uneven global growth. Declining EV demand in

Europe and the US, coupled with China’s shift toward PHEVs and LFP/

LMFP chemistries, could pressure nickel intensity in batteries. Indonesia’s

new ore permitting regime has capped supply growth and ore shortages

may intensify if government restrictions tighten further in 2025, potentially

leading to production surprises on the downside.

Reference date: January 25, 2025

46-47_manickelstainless.indd 47 29-01-2025 11:29