Page 65 from: October 2016

65October 2016

Ferrous

higher in the Middle East at 2.216 mil-

lion tonnes while Turkey’s output surged

almost 13% from 2.528 million tonnes

in August 2015 to 2.853 million tonnes

in this year’s corresponding month.

Conversely, latest statistics from the

World Steel Association (WSA) reveal

August production declines for all of the

other leading steelmaking countries and

regions, including the EU-28 (-1.4%),

the USA (-3.4%), Russia (-1.9%),

Ukraine (-4.1%), South America

(-6.6%) and Africa (-6%).

The net result of this mixed performance

was that the 66 countries reporting to

the WSA produced a total of 134.125

million tonnes of crude steel in August

for an increase of 1.9% over the same

month last year. At 68.5%, global

capacity utilisation outstripped that for

both August 2015 and July 2016 by,

respectively, 0.5 and 0.1 percentage

points.

Nevertheless, world steel output was

0.9% lower in the first eight months of

this year at 1.065 billion tonnes. Among

the major producers, only India (+5.6%

to 63.21 million tonnes), Turkey (+4.7%

to 22.005 million tonnes) and Ukraine

(+8.6% to 16.334 million tonnes) reg-

istered year-on-year gains for the Jan-

uary-August period. The biggest losses

were recorded by the EU-28 (-5.2% to

107.931 million tonnes), South America

(-12.5% to 26.091 million tonnes) and

Africa (-12.9% to 8.02 million tonnes)

whereas far smaller declines were post-

ed by the USA (-0.9% to 53.455 million

tonnes), Russia (-1.6% to 47.031 mil-

lion tonnes), Japan (-0.4% to 69.944

million tonnes), South Korea (-2.1% to

45.236 million tonnes) and the Middle

East (-2.6% to 18.215 million tonnes).

Outlook

Anyone anticipating a seasonal rally

in ferrous scrap prices will have been

sorely disappointed to date. Values have

suffered steady erosion over the course

of September as many buyers looked to

keep the marketplace at arm’s length.

At the time of writing this report on the

eve of the fourth quarter, most ferrous

scrap experts were talking more about

price risks than a price run-up for the

near term.

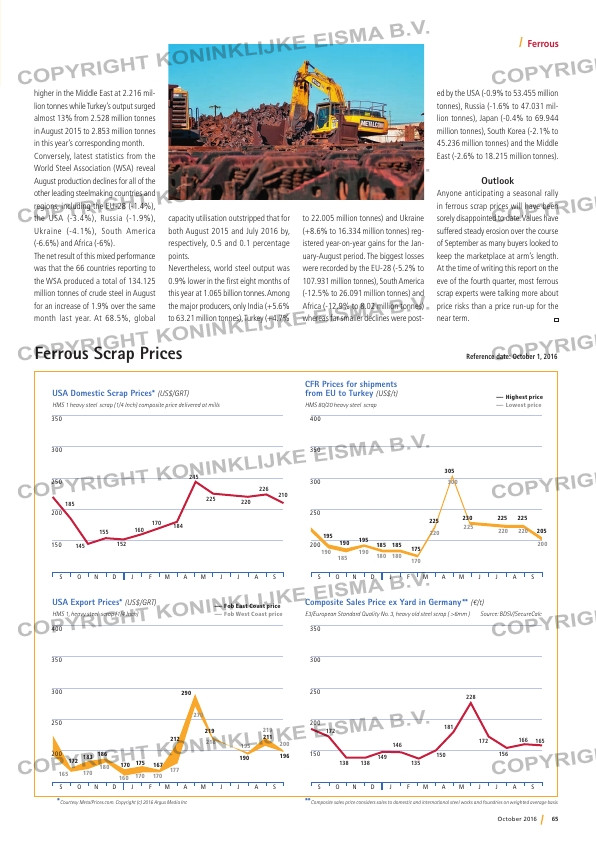

Ferrous Scrap Prices Reference date: October 1, 2016

Want to know more? +31 263 120 994

[email protected]

Recycling International is a must-read

magazine for everything you need to know about

latest developments in the recycling business.

Recycling International:

• an invaluable source of information on the

all-important global recycling issues of the day;

• featuring contributions from the most prominent

and infl uential players in the recycling industry

worldwide;

• providing readers with all the latest news with a

vital bearing on their own businesses;

• reaching out to more than 30 000 industry leaders

and decision-makers in more than 125 countries.

Recycling Technology is an annual publication

dedicated to new technologies deployed in all

sectors of the global recycling industry.

It includes:

• informative articles about state-of-the-art

recycling technology written by researchers

and scientists from technical universities and

R&D institutes around the world;

• application stories from companies which

develop their own recycling technologies.

Subscriptions include:

• Print edition of

Recycling International (8 x a year)

• Access to the App

• Weekly e-newsletter

• Access to all feature articles published

over the past 18 years

• Recycling Technology 2016/17

Powered by Recycling International

and with a print run of some 9 000

copies, Recycling Technology will be

on display at numerous congresses

and trade shows around the world.

www.recyclinginternational.com

Keep abreast of new

recycling technologies

Much more

than just a magazine

March 2016, N

o.2

E-scrap: New b

usiness

models crucial

to survival

Signs of improv

ement at

South Asia’s sh

ipbreaking

yards

How China’s slo

wdown

has affected PG

M prices

David Chiao: ‘M

anaging a

business is like

managing

a kitchen’

Technology: Wh

at’s new

in sensor-based

sorting?

Hands off

our scrap!

Keeping the thie

ves out

April 2016, No.

3

Sky-high taxes

killing

Russia’s scrap m

etals

industry

Second life for

tyres

on Egypt’s socc

er

fi elds

Scholz group ca

lls

for setting up o

f ELV

think-tank

The young

ones

Educating the n

ext generation

May 2016, No.4

Highlights from

the

ISRI 2016 Conv

ention & Expo

Yale lecturer: ‘T

allest

skyscrapers ind

icate

bubbly conditio

ns’

‘Fast Track’ mod

el to

simplify EU cro

ss-border

e-scrap movem

ents

Steel overcapa

city ‘not

just a Chinese i

ssue’

Power

brand

The secret of ‘M

ade in Germany

’

machinery & tec

hnology

June/July 2016

, No.5

Scrap collection

system still in n

eed

of repair

Cradle-to-cradl

e

ambassador Le

wis

Perkins

San Francisco’s

troubled recycl

ing

centres

Buckle

up for a

rough ride

BIR in Berlin:

Keep informed

and subscribe now!

bit.ly/subscribeRI

210 x 297

2016

• Ultimately, will everything get

recycled?

• Quantifying the resource

savings delivered by recycling

• Stripping precious and base

metals from e-waste

• An alternative approach to

rare earth elements

Powered by

Recycling

International

Top scientists share

innovations and insights

2017

• Direct reuse of complex aerospace aluminium alloys

• Yellow alert: the effects of light on recycled PET

• Treatment of incineration ashes

• Shock-wave recycling of lithium-ion batteries

Powered by

Recycling

International

Sensor s rting –

High-defi nition recycling

Media

Planner 2017

is now

out!

September 201

6, No.7

Remote recycli

ng

outpost: Antarc

tica

John Shegerian

’s

e-scrap empire

Second life for

guitar strings

Preview of K 20

16

trade show

Carbon fi bre’s

recycling boom

—– Highest price

—– Lowest price

** Composite sales price considers sales to domestic and international steel works and foundries on weighted average basis* Courtesy MetalPrices.com. Copyright (c) 2016 Argus Media Inc

USA Domestic Scrap Prices* (US$/GRT)

HMS 1 heavy steel scrap (1/4 Inch) composite price delivered at mills

USA Export Prices* (US$/GRT)

HMS 1, heavy steel scrap (1/4 Inch)

CFR Prices for shipments

from EU to Turkey (US$/t)

HMS 80/20 heavy steel scrap

350

300

250

200

150

S O N D J F M A M J J A S

S O N D J F M A M J J A S

S O N D J F M A M J J A S

S O N D J F M A M J J A S

350

300

250

200

150

172

172

138172

183

211

196186

170 175 167

212

290

219

190

180

160 170 170

177

270

218

195

219

200

165 170

195

190 195 185

175

225

305

230 225 225

205

185

—– Fob East Coast price

—– Fob West Coast price

190

185

190

180

170

220

300

225

220 220

200

180

185

145

155

152

160

170 184

245

225 220

226

210

400

350

300

250

200

400

350

300

250

200

Composite Sales Price ex Yard in Germany ** (€/t)

E3/European Standard Quality No. 3, heavy old steel scrap ( >6mm ) Source: BDSV/SecureCalc

149

146

135

150 156

166 165

181

228

138