Page 12 from: November/December issue

12

Novelis aNd traFigUra set Up New

Facilities

Novelis has

broken ground

on the expan-

sion of its auto-

motive alumi-

num manufac-

turing facility in

Changzhou,

China. The US$

180 million

(EUR 157 mil-

lion) investment

will double the

facility’s production capacity of heat-treated aluminum sheet by 100

000 tonnes to better meet the growing demand for automotive alu-

minum in Asia. The facility will also be equipped with a high-speed

slitter, and a fully automated packaging line. The expansion is

expected to create approximately 160 jobs. The project is sched-

uled to be completed in 2020.

In another development, Trafigura is to establish an integrated cop-

per, zinc and lead smelting-refining complex in Saudi Arabia.

FastMarkets MB (formerly Metal Bulletin) reported that the multi-

billion-dollar project in Ras Al-Khair Mineral City, will be jointly

developed and equally owned by Trafigura and Modern Mining

Holding – an affiliate of the Riyadh-based Modern Industrial

Investment Holding Group. A binding agreement to finance and

operate the complex has been backed by Saudi Arabia’s Ministry of

Energy, Industry & Mineral Resources.

On the other hand, Fastmarkets also reported that Alcoa is shutting

its aluminium smelting operations at La Coruña and Avilés in Spain.

The plants have a combined output of 180 000 tonnes per year pro-

ducing primary aluminium, billet and slabs. The company blamed

small production capacity, less efficient technology and high fixed

costs for the closure. Alcoa said it had attempted to reduce costs

and maintain jobs but the plants remained uncompetitive.

aUdi aNd Umicore aim to recover 95%

oF battery metals

Audi and Umicore have successfully completed the first phase

of their strategic research cooperation for battery recycling.

They are developing a closed loop ‘raw materials bank’ for

components of high-voltage batteries so valuable metals will

not be wasted.

Audi analysed the batteries used to power its latest vehicle, the

A3 E-tron plug-in hybrid car, and defined ways of recycling

them before launching its collaboration with Umicore this June.

The car manufacturer is determined to boost the recycling rates

for battery components such as cobalt, nickel and copper.

The outcome of this new partnership is said to be ‘very promis-

ing’. Umicore, which is based in Belgium, says laboratory tests

suggest that more than 95% of these elements can be recov-

ered and reused. Audi manufactures vehicles at 16 locations in

12 countries. Last year, the group sold 1.878 million cars.

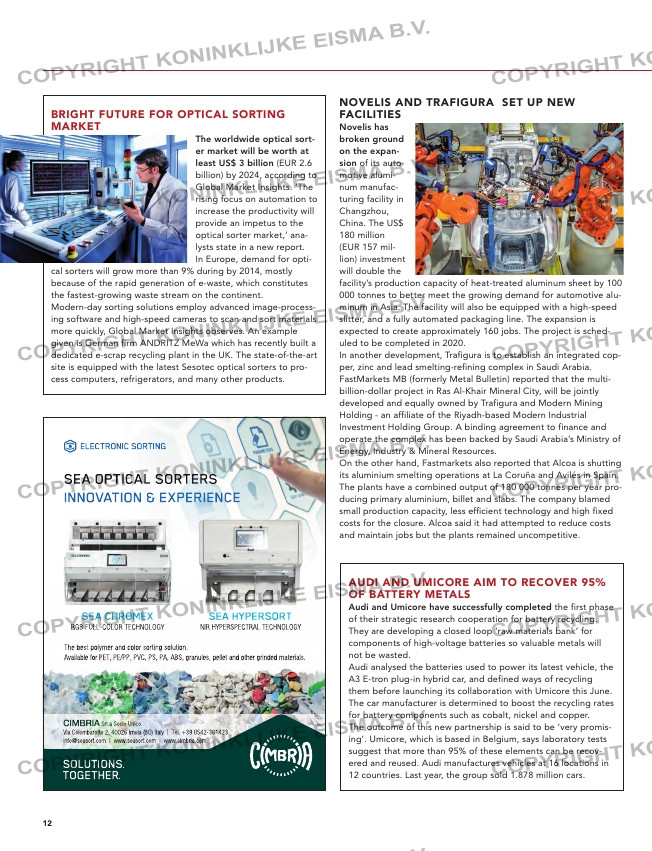

bright FUtUre For optical sortiNg

market

The worldwide optical sort-

er market will be worth at

least US$ 3 billion (EUR 2.6

billion) by 2024, according to

Global Market Insights. ‘The

rising focus on automation to

increase the productivity will

provide an impetus to the

optical sorter market,’ ana-

lysts state in a new report.

In Europe, demand for opti-

cal sorters will grow more than 9% during by 2014, mostly

because of the rapid generation of e-waste, which constitutes

the fastest-growing waste stream on the continent.

Modern-day sorting solutions employ advanced image-process-

ing software and high-speed cameras to scan and sort materials

more quickly, Global Market Insights observes. An example

given is German firm ANDRITZ MeWa which has recently built a

dedicated e-scrap recycling plant in the UK. The state-of-the-art

site is equipped with the latest Sesotec optical sorters to pro-

cess computers, refrigerators, and many other products.

Commitment

Advanced global design, manufacturing and customer support.

metso.com/metal-recycling

Achieve Greater Efficiencies. Ask Metso.

N-Series™ Lindemann™ Texas Shredder™

Pre-Shredders • Shredders • Shears • Balers • Briquetters

Uk dismaNtler to scrap

oFFshore gas platForms

Vessel and oil drilling platform dismantler Able

UK has been awarded the contract to recycle and

dispose of natural gas platforms from the Sable

Offshore Energy Project (SOEP) operated by

ExxonMobil Canada off the coast of Nova Scotia.

The project will be managed by the Able Seaton

Port facility on the River Tees in north-east England

and the first shipment of the structures is sched-

uled to arrive there in the second quarter of 2020.

‘This contract reflects our reputation and the

expertise we have built up over many years as

leaders in the rapidly developing offshore decom-

missioning sector,’ says Able UK ceo Peter

Stephenson.

The project will involve the removal of seven plat-

forms and their jackets using one of the biggest

crane vessels in the world, the Heerema Thialf, with

the components being transported to Able Seaton

Port by barge. The onshore dismantling, recycling

and disposal work is due to be completed within

ten months.

10-11-12-13-42-43-44-45_trendsupdates1.indd 12 31-10-18 15:54