Page 37 from: November 2011

37November 2011

State responsibility

It’s fair to say the related regulatory landscape

of the US Environmental Protection Agency

(EPA) is limited. Regarding electronic waste, the

US-wide multi-disciplinary Resource Conserva-

tion and Recovery Act (RCRA) features only

some legislation on cathode ray tube screens

and lead-acid batteries. A total of 25 US states

have some sort of extended producer responsi-

bility laws; 15 have enacted certain landfill bans.

There are developments taking place, but these

revolve mainly around stimulating voluntary

industry commitments and actions. The EPA

is just in the process of convening, surveying,

interviewing and assessing the sector’s stake-

holders and is limited in the setting-up of a

regulatory framework as states are independ-

ently responsible for establishing and enforcing

legislation on waste management issues.

At the federal level, one key moment this year

was the laun ch of the National Strategy for

Electronics Stewardship. According to EPA offi-

cial Betsy Smidinger, this will promote the

development of more efficient and sustainable

electronics products. ‘It requires federal agen-

cies to buy, use, reuse and recycle their electron-

ics responsibly; support recycling options and

systems for American consumers; and strength-

en America’s role in international electronics

stewardship,’ she summarises.

Among other things, it is claimed the strategy

will support research, provide technical assist-

ance and establish partnerships with develop-

ing countries to better manage used electronics.

Certification approach

The new national strategy promises to improve

information on trade flows and handling of

used electronics, and to share data with federal

and international agencies. And worthy of note

in this regard is the fact that the EPA supports

the ratification of the Basel Convention on the

Control of Transboundary Movements of Haz-

ardous Wastes and their Disposal.

Unlike setting strict recycling legislation, as

happens in the EU, the approach in the USA is

to follow the guidance of certification pro-

grammes; specifically, these are the R2 certifica-

tion scheme established by ISRI and supporting

organisations in 2009, and the competing

e-Stewards certification initiative unveiled in

2010 by the Basel Action Network – a US non-

governmental organisation which fights the

export of discarded electronics.

OEM perspective

Electronics-producing OEMs do not like to see

their products pictured in piles of discards

waiting to be processed in an unsafe environ-

ment. Therefore, along with other organisa-

tions, they require recyclers of their equipment

to become part of these certification pro-

grammes which set recycling standards.

According to research, this is the main reason

why recyclers subscribe to these standards.

Some OEMs, like IBM, have implemented their

own certification and auditing programmes

worldwide which often coincide with national

and regional requirements.

Internally, the EPA also adopts the certification

route, forcing all US government agencies to

consign their spent electronics to a certified

recycler. And EPA administrators are currently

preparing minimum environmental criteria for

certification programmes, with which all cer-

tification schemes will need to align themselves.

In its December 2011 issue, Recycling Interna-

tional will explore in greater depth the simi-

larities, differences and fierce competition

between these programmes.

Expansion plans

Amid all this legislative and standardisation activ-

ity, those in the USA who are engaged day to day

in the actual recycling of e-waste have been expe-

riencing a commercially satisfying period. Con-

gress organiser Resource Recycling conducted a

survey among e-scrap recyclers and found that

62% of processors plan on expanding capacity in

2012. In 2010, however, the average weight han-

dled by each recycler was lower than in 2009 and

2008. But 82% of the survey’s respondents noted

that material values have risen in the past year and

processors are reporting healthy operating mar-

gins. Strong competition between processors

means securing volumes is the main challenge for

recyclers. Currently, refining capacity is accelerat-

ing in the USA for extraction of valuable metals

from motherboards and other electronic compo-

nents. Until recently, a large share found its way

to good-paying European refining majors such

as Boliden, Aurubis and Umicore.

Proprietary technology

To exploit ‘urban mines’, North American refin-

ers like ECS Refining, Colt Refining, Metallix,

Teck Resources, MST and Xstrata have added

new capacities and better processes. European

scrap metal conglomerate Kuusakoski Oy will

open a modern scrap handling plant shortly in

Philadelphia which will include proprietary

recycling technology capable of delivering mill-

ready metals.

Even Graham Davy, CEO of Sims Recycling

Solutions (SRS), the world’s largest recycler of

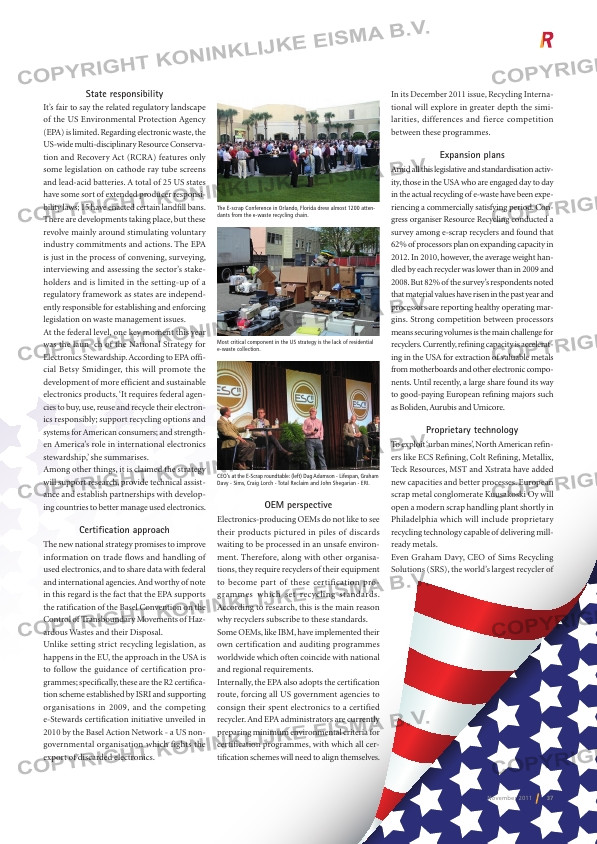

The E-scrap Conference in Orlando, Florida drew almost 1200 atten-

dants from the e-waste recycling chain.

Most critical component in the US strategy is the lack of residential

e-waste collection.

CEO’s at the E-Scrap roundtable: (left) Dag Adamson – Lifespan, Graham

Davy – Sims, Craig Lorch – Total Reclaim and John Shegarian – ERI.

p03 _ – p in .indd 37 07-11-11 1 :1