Page 79 from: November 2007

ondary aluminium smelters in the

USA with an opportunity to buy pri-

mary grade scrap that they were un-

able to purchase in the past, with

UBCs now carrying a lower value

than Twitch or certain grades of

sheet aluminium or extrusions.

On the primary side, Barclays

Capital forecasts that aluminium

will be trading at around US$ 3000

per tonne – or US$ 1.36 per lb – by

the end of next year.

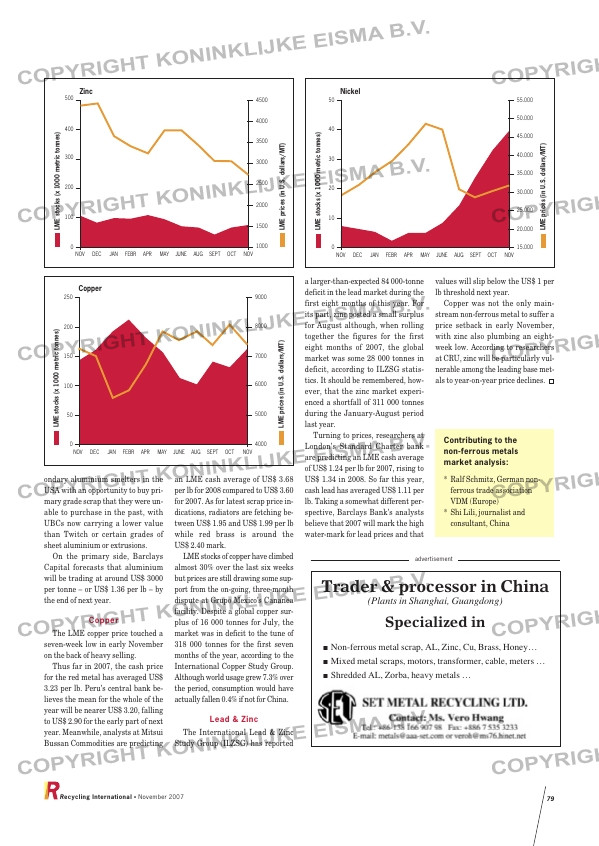

Copper

The LME copper price touched a

seven-week low in early November

on the back of heavy selling.

Thus far in 2007, the cash price

for the red metal has averaged US$

3.23 per lb. Peru’s central bank be-

lieves the mean for the whole of the

year will be nearer US$ 3.20, falling

to US$ 2.90 for the early part of next

year. Meanwhile, analysts at Mitsui

Bussan Commodities are predicting

an LME cash average of US$ 3.68

per lb for 2008 compared to US$ 3.60

for 2007. As for latest scrap price in-

dications, radiators are fetching be-

tween US$ 1.95 and US$ 1.99 per lb

while red brass is around the

US$ 2.40 mark.

LME stocks of copper have climbed

almost 30% over the last six weeks

but prices are still drawing some sup-

port from the on-going, three-month

dispute at Grupo Mexico’s Cananea

facility. Despite a global copper sur-

plus of 16 000 tonnes for July, the

market was in deficit to the tune of

318 000 tonnes for the first seven

months of the year, according to the

International Copper Study Group.

Although world usage grew 7.3% over

the period, consumption would have

actually fallen 0.4% if not for China.

Lead & Zinc

The International Lead & Zinc

Study Group (ILZSG) has reported

Copper

LM

E

st

oc

ks

(x

1

00

0

m

et

ri

c

to

nn

es

)

0

50

100

150

200

250

4000

5000

6000

7000

8000

9000

LM

E

pr

ic

es

(i

n

U

.S

. d

ol

la

rs

/M

T)

FEBR AUGNOV DEC JAN SEPT NOVOCTAPR JUNEMAY

LM

E

st

oc

ks

(x

1

00

0

m

et

ri

c

to

nn

es

)

0

10

20

30

40

50

LM

E

pr

ic

es

(i

n

U

.S

. d

ol

la

rs

/M

T)

Nickel

15.000

25.000

35.000

20.000

40.000

45.000

50.000

55.000

30.000

FEBR AUGNOV DEC JAN SEPT NOVOCTAPR JUNEMAY

Zinc

LM

E

st

oc

ks

(x

1

00

0

m

et

ri

c

to

nn

es

)

0

500

400

300

200

100

1000

1500

2000

2500

3000

3500

4000

4500

LM

E

pr

ic

es

(i

n

U

.S

. d

ol

la

rs

/M

T)

FEBR AUGNOV DEC JAN SEPT NOVOCTAPR JUNEMAY

Recycling International • November 2007 79

a larger-than-expected 84 000-tonne

deficit in the lead market during the

first eight months of this year. For

its part, zinc posted a small surplus

for August although, when rolling

together the figures for the first

eight months of 2007, the global

market was some 28 000 tonnes in

deficit, according to ILZSG statis-

tics. It should be remembered, how-

ever, that the zinc market experi-

enced a shortfall of 311 000 tonnes

during the January-August period

last year.

Turning to prices, researchers at

London’s Standard Charter bank

are predicting an LME cash average

of US$ 1.24 per lb for 2007, rising to

US$ 1.34 in 2008. So far this year,

cash lead has averaged US$ 1.11 per

lb. Taking a somewhat different per-

spective, Barclays Bank’s analysts

believe that 2007 will mark the high

water-mark for lead prices and that

values will slip below the US$ 1 per

lb threshold next year.

Copper was not the only main-

stream non-ferrous metal to suffer a

price setback in early November,

with zinc also plumbing an eight-

week low. According to researchers

at CRU, zinc will be particularly vul-

nerable among the leading base met-

als to year-on-year price declines.

Contributing to the

non-ferrous metals

market analysis:

* Ralf Schmitz, German non-

ferrous trade association

VDM (Europe)

* Shi Lili, journalist and

consultant, China

Non-ferrous metal scrap, AL, Zinc, Cu, Brass, Honey…

Mixed metal scraps, motors, transformer, cable, meters …

Shredded AL, Zorba, heavy metals …

Trader & processor in China

(Plants in Shanghai, Guangdong)

Specialized in

advertisement

RI_058 MA Non-Ferrous:MA Non-Ferrous 08-11-2007 09:27 Pagina 79