Page 25 from: November 2005

the reduced demand for deep-sea cargoes, it was

suggested. For the moment, Japan was the leading

supplier of scrap to China, Korea and Taiwan: dur-

ing the first half of 2005, around 28% of these coun-

tries’ combined imports had been sourced from

Japan compared to some 21% from the USA.

According to Mr Sutcliffe’s report, another factor

affecting exporter markets had been the reduction

in finished steel product prices in China at the

beginning of October. This had contributed to the

current weak sentiment in Asia, he added.

EFR President Christian Rubach of Interseroh in

Germany reported that the European ferrous scrap

organisation was constantly striving to improve co-

operation with other associations such as the EU

steel producer association Eurofer and the EU

Commission. At present, he explained, a joint work-

ing group with Eurofer was reviewing scrap specifi-

cations and the two bodies were looking to adopt a

common approach to the waste/non-waste distinc-

tion.

Mills hit by raw material costs

According to the guest presentation from Antonio

Gozzi, Managing Director of Italian steel group

Duferco, the first quarter of this year had been a

good one for steel prices whereas the second three-

month period had produced a steep fall in prices due

mainly to de-stocking. Subsequent re-stocking had

led to a price rebound in the third quarter.

An increase of almost 75% in ore costs and a

100% jump in coal prices had proved a massive set-

back for mills. They had also been hit by the

increase in scrap prices – a particular problem for

Italy given its 62.5% electric arc furnace production

ratio, which is the third highest in Europe after

Luxembourg and Spain.

Mr Gozzi foresaw that worldwide over-capacity

in the steel market would offer a severe threat to

mills in the near future (see graph).

B I R M I L A N

Recycling International • November 2005 25

A dozen new shredders

The Chairman of BIR’s Shredder Committee, Jens Hempel-Hansen of H.J.Hansen

Recycling Industry in Denmark, expressed doubts about the workability of the current

2015 targets set by the EU for the reuse/recycling of end-of-life vehicles (ELVs). It is

expected that, around the turn of the year, there will be a recommendation from the

EU Commission to the European Parliament and Council of Ministers to revise the

2015 target, the meeting heard.

Robin Wiener, President of the US Institute of Scrap Recycling Industries, reported

on talks with the US Environmental Protection Agency aimed at developing a part-

nership approach to research covering the recovery of materials from ELVs.

Shredder Committee board member Jim Schwartz of Texas Shredder Inc. in the USA

reported that, throughout the world, there were now over 700 shredders of 1000HP or

more, while total production capacity was between 75 and 90 million tonnes per annum.

Since this year’s BIR Spring Convention in May, six shredders had come on stream in

the USA – three of 4000HP, one of 6000HP, one of 2500HP and another of 8000HP.

Over the same period, four new shredders of 1400, 2000, 4000 and 5000HP had started

up in Europe while two large units

had come on stream in Australia.

Given the size of some of these

giant machines, it was foreseen

that material up to two inches

thick could be processed. Hence,

the 80/20 and 60/40 mixtures of No

1 and No 2 scrap might diminish

significantly as these qualities

would become easily shreddable,

Mr Schwartz concluded.

John Harris of Mittal Steel (left) and Shredder

Committee board member Jim Schwartz of

Metso Texas Shredder Inc.

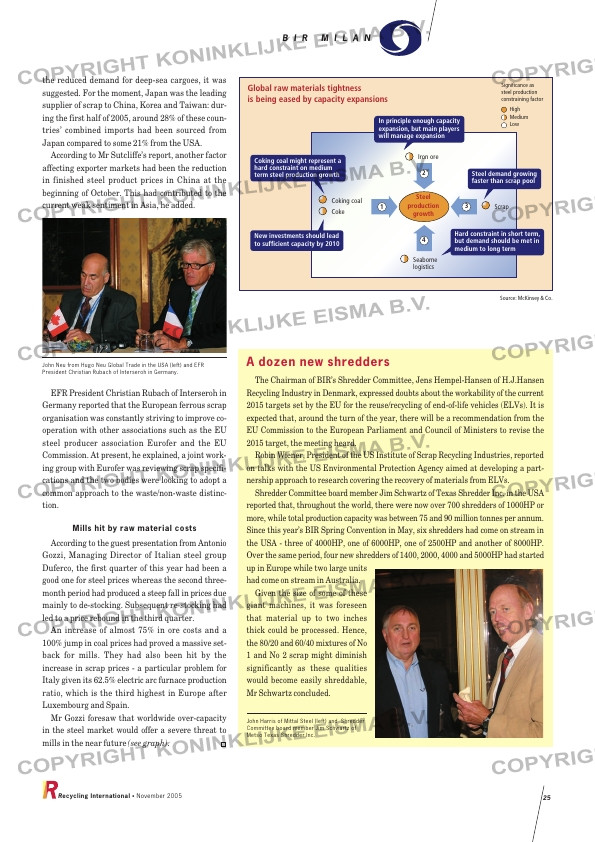

Global raw materials tightness

is being eased by capacity expansions

Coking coal

Coke

Significance as

steel production

constraining factor

High

Medium

Low

Iron ore

Seaborne

logistics

Scrap

Steel

production

growth

1

2

4

3

In principle enough capacity

expansion, but main players

will manage expansion

Steel demand growing

faster than scrap pool

Hard constraint in short term,

but demand should be met in

medium to long term

Coking coal might represent a

hard constraint on medium

term steel production growth

New investments should lead

to sufficient capacity by 2010

John Neu from Hugo Neu Global Trade in the USA (left) and EFR

President Christian Rubach of Interseroh in Germany.

Source: McKinsey & Co.

RI_017 BIR ferrous 04-11-2005 09:42 Pagina 25