Page 47 from: June / July 2008

47June/July 2008

Ferrous

each year, announced in April that it

would increase its June delivery prices

by U$ 180 per tonne but upped the

figure last month to US$ 270 per tonne

effective June 1. For July, an increase in

its spot sales prices of US$ 90 per short

ton has already been announced,

thereby pushing levels above US$ 1100

per short ton or US$ 1200 per metric

tonne. Arcelor-Mittal has taken the very

unusual step of asking its contract cus-

tomers in the EU and the USA to pay a

raw materials surcharge of US$ 250

per tonne with effect from July 1.

Southern European prices for discrete

plate has jumped to over US$ 1275

per tonne, with lead times having

extended from 7 to 8.5 weeks.

The earthquake in China has idled

three steel mills to date and endan-

gered production of the long construc-

tion steel required in large volumes to

rebuild the 3.5 million-plus houses

and other buildings destroyed in and

around Sichuan province. Many trans-

port lines have been blocked or cut by

Also in mid-May, Brazilian pig iron was

sold for US$ 810 per tonne cfr New

Orleans – or US$ 100 more than at the

end of April. But lower volumes of Bra-

zilian pig are being exported at pres-

ent owing to climatic reasons follow-

ing a shortage of charcoal and to

higher domestic demand. The country’s

exports of iron ore have also declined:

in the first four months of 2008, Brazil

exported 80 million tonnes, of which

30 million tonnes went to China, 9.5

million to Japan and 6.7 million to

Germany. This total compares to nearly

83 million tonnes in the same period

last year. For shipping from Brazil to

China, the cost of chartering a Cape-

size bulk dry cargo carrier of around

125 000 tonnes is around US$ 100

per tonne, or double that prevailing at

the start of the year and also double

the current cost from Australia to

China. Spot iron ore prices have now

reached US$ 200 per tonne fob.

DRI and HBI prices have increased

more modestly to over US$ 700 per

tonne fob Venezuela for delivery in

September – a level similar to scrap.

The elevated Venezuelan prices are

being attributed to high demand, ever-

rising scrap prices and a shortage of

supply given that only 4.8 million

tonnes of HBI were produced last year.

Some countries are building new pro-

duction facilities: for example, Malay-

sia will almost double its capacity to

approaching 6 million tonnes this year

while Iran will add a further 3.5 million

tonnes of capacity in the 12 months to

March 2009.

Canada’s Elk Valley mining company,

which claims to be the world’s second

largest exporter of sea-borne metallur-

gical coal, has been selling its product

of late at US$ 275 per tonne compared

to US$ 93 in 2007. Chinese production

is currently meeting some 60% of

world demand for coke.

Steel

Steel mills everywhere, whether they

be integrated or electric arc, are com-

plaining of dramatic increases in their

ore, coal and alloy costs as well as of

spiralling energy costs – all of which

currently amount to US$ 300-500 per

tonne of steel produced. Mills with no

fixed annual contract for ore and coal

find themselves towards the top end

of this cost band.

One of the main victims of the steel

price explosion is the automotive

industry whose purchase prices for

cold rolled coil and other qualities

have almost doubled this year. It is

questionable whether they will be

able to pass all of these higher costs

on to their customers.

Rebar prices are also rising by the day.

CIS countries were demanding US$

1130 per tonne fob Black Sea in mid-

May and some mills have even asked

the same price for billet on a cfr Persian

Gulf countries basis – a price some US$

120 higher than the April level. In May,

Turkish mills were offering rebar at

US$ 1400 per tonne fob and billet at

US$ 1200 for third-quarter deliveries to

the Middle East. In Western Europe, the

rebar price has exceeded Euro 800 per

tonne delivered (US$ 1265) with July/

August delivered prices likely to be

above Euro 850 per tonne (US$ 1350).

For June deliveries, CIS slab is being

offered at US$ 1100-1200 per tonne

cfr and billet at more than US$ 1000

fob Black Sea.

Lower steel stocks

Many steel stockholders are complain-

ing that their inventories have dimin-

ished markedly since customers

changed tactics and started ordering

volumes in excess of their current

needs for fear of further price increas-

es. SBB has reported that, globally,

well over 80% of stockholders and

consumers of steel expect higher pric-

es in the next three months.

US stockholders have confirmed that

stocks were 33% lower in May while

the decline in Europe was greater than

40%. Average lead times for rebar

lengthened from four to six weeks in

April. Nucor in the USA, which produc-

es some 24 million tonnes of EAF steel

C

ru

de

s

te

el

p

ro

du

ct

io

n

an

d

fin

is

he

d

st

ee

l u

til

iz

at

io

n

in

m

ill

io

n

t

Quelle: IISI SRO März 2008

Source: WV Stahl

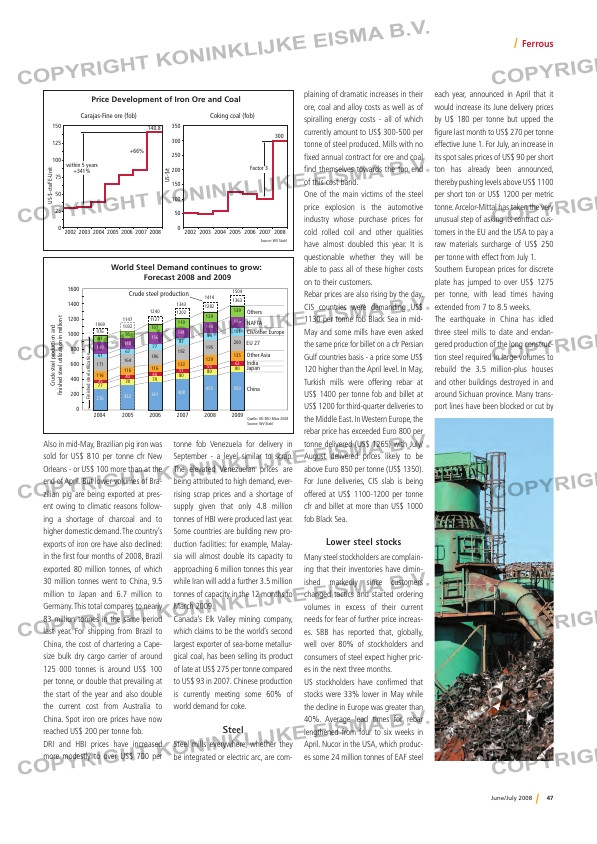

World Steel Demand continues to grow:

Forecast 2008 and 2009

1600

1400

1200

1000

800

600

400

200

0

2004 2005 2006 2007 2008 2009

Crude steel production

1069

976

91

149

61

171

116

35

77

276

1147

1032

95

140

67

164

116

40

78

332

1240

1127

107

156

77

186

116

46

79

361

1414

1282

129

144

94

195

129

55

80

455

1504

1363

139

146

101

200

135

62

80

500

Fi

ni

sh

ed

s

te

el

u

til

iz

at

io

n

Others

NAFTA

Cis/other Europe

EU 27

Other Asia

India

Japan

China

1343

1202

119

141

87

192

123

51

80

408

Price Development of Iron Ore and Coal

Source: WV Stahl

150

125

100

75

50

25

0

350

300

250

200

150

100

50

0

2002 2003 2004 2005 2006 2007 2008 2002 2003 2004 2005 2006 2007 2008

U

S-

$-

ct

s/

FE

-U

ni

t

U

S-

$/

t Factor 3

within 5 years

+341%

+66%

140.8

300

Coking coal (fob)Carajas-Fine ore (fob)

RI_037 MA-Ferrous.indd 47 20-06-2008 08:49:33