Page 25 from: Recycling International February issue | 2022

25recyclinginternational.com | January/February | 2022

competitors? There will be some over-

lap with others, expects Igneo’s ceo.

‘But we go after a segment of the mar-

ket that others don’t. Most electronic

recyclers in the US today are basically

collectors of materials which they scrap,

sort and send to smelters. Instead, we

go after the material the smelter cannot

take, either for technical or, mostly, eco-

nomic reasons. We remove the deleteri-

ous elements and upgrade them using

our technology, delivering a sustainable

copper concentrate that the smelter

prefers to take.’

NEXT STOP: WEST COAST

In the perfect world, says Mir, multiple

facilities would be upgrading copper

and precious metals otherwise lost to

landfill and sending them to smelters

around the globe.

Asked how many new Igneo plants

will actually pop up by 2030, he

replies: ‘Probably six. That’s an expan-

sion in France/Europe and multiple

plants in the US, including Savannah

and a second site probably on the

West Coast,’ adding that Igneo is busy

searching for locations.

Igneo has managed to successfully run

a facility in ‘highly regulated’ France.

‘True, France is perhaps one of the

most stringent jurisdictions when it

comes to environmental legislation. I

always tell people “if you can operate

a facility in France, you can run a facili-

ty anywhere in the world and it’s a

true testament to our environmentally

clean technology ”.’

ATLANTA AND VEGAS HUBS

Building modern facilities in the US to

process materials is one thing, getting

hold of the volumes is another.

‘Logistics is the biggest challenge,’

says Mir. ‘You move stuff around that

has low value and there is no collec-

tion infrastructure for these materials

in the US,’ he points out.

Igneo is developing its own collection

system ‘from the ground up’. ‘We are

building eight hubs to reach every

household in the US.’ The first has

recently opened in Atlanta while a

second in Las Vegas is expected to be

operational by March. Both include

sorting and shredding services.

Additional collection hubs are to be

established soon after the initial two

in the northeast, midwest and on the

west coast. In addition to building out

its own hubs, Igneo is targeting acqui-

sitions of hubs as well as developing

strategic relationships with current

market players.

EDUCATIONAL ROLE

Another big challenge, Mir argues, is

to change how people think. ‘I don’t

want to sound too corny but sustain-

ability is all about people – we are the

ultimate beneficiaries of a healthy

planet. Whatever we do, whatever

choices we make in our day-to-day

lives, has consequences – has impact.’

In order to educate people, Igneo

plans visitor centres at each of the

facilities, starting at Savannah. ‘We

want to show people how we recycle

and provide a level of transparency

that is missing in our industry in addi-

tion to educating them of the conse-

quences of not recycling.’

By the end of 2022, Igneo will have

invested over US$ 150 million in the

US operations alone. This investment

will continue thereafter into new mar-

kets and geographies. ‘We have no

shortage of partners who want to

work, invest and grow with us.’

of Georgia. The US$ 110 million (EUR

99 million) project will be up and run-

ning from the fourth quarter of 2023.

Mir: ‘The focus of the Savannah oper-

ation will be on electronic scrap resi-

dues, a blend of low-grade electric

devices; small toys, remote controls,

meters and various other low grade

electronics with high plastic content.’

THE CONSUMER UPRISING

The entrepreneur is well aware that

setting up an e-scrap business in

Europe is different from establishing

an operation in the US. ‘In Europe

recycling rates are high due to legisla-

tion. That’s very different from the US,

where legislation is generally missing.

California is an exception but most US

states have no proper rules for e-scrap

so a lot of materials continue to end

up in landfills.’

At the same time, Mir observes a phe-

nomenon he describes as a ‘consumer

uprising’. ‘Our timing is perfect: con-

sumers increasingly demand that com-

panies in general, and big brands and

original equipment manufacturers in

particular, are doing the right thing.

There is a wave of doing the right

thing. But at the same time we see a

huge gap between wanting to do the

right thing and actually doing it. We

hope we can be a part of bridging

that gap.’

Igneo wants to give companies and

consumers an outlet to become

greener. ‘We have the technology and

the infrastructure to process the mate-

rials that now go to landfill,’ says Mir.

It will not be enough for the company

to be ‘just an e-scrap recycler’. It

wants to do it the sustainable way:

‘For us, how we recycle is very impor-

tant and we are always looking for

ways to reduce our carbon foot print.’

Through the constant evolution of

their technology, the Igneo team has

implemented an auto thermal process

in 2021.

Igneo claims to have reduced natural

gas consumption by 90% to 95%. ‘Our

ultimate goal is to recycle electronic

scrap at our pyrolysis plants without

using fossil fuels but utilising the heat of

our furnace. We’re not far from that.’

‘WE ARE A LITTLE DIFFERENT’

Looking at the US market, what about

WHAT IS PYROLYSIS?

Pyrolysis is the chemical decomposition of organic (carbon-based) materials

through the application of heat. Also the first step in gasification and com-

bustion, pyrolysis occurs in the absence or near absence of oxygen, and is

distinct from combustion (burning) which takes place only if sufficient oxy-

gen is present.

The six-stage process at Igneo France

1. Crushing (to 20 mm and then 6 mm)

2. Sampling (in-process, automated sampling tower)

3. Blending

4. Separation (iron and aluminium removed by magnetic overband and

eddy-current system)

5. Pyrolysis (500˚C furnace removes plastics and resins)

6. Sanitation (off-gases treated in a six-stage process including injection and

filtration)

7. Analysis (spectrometry in Igneo’s lab)

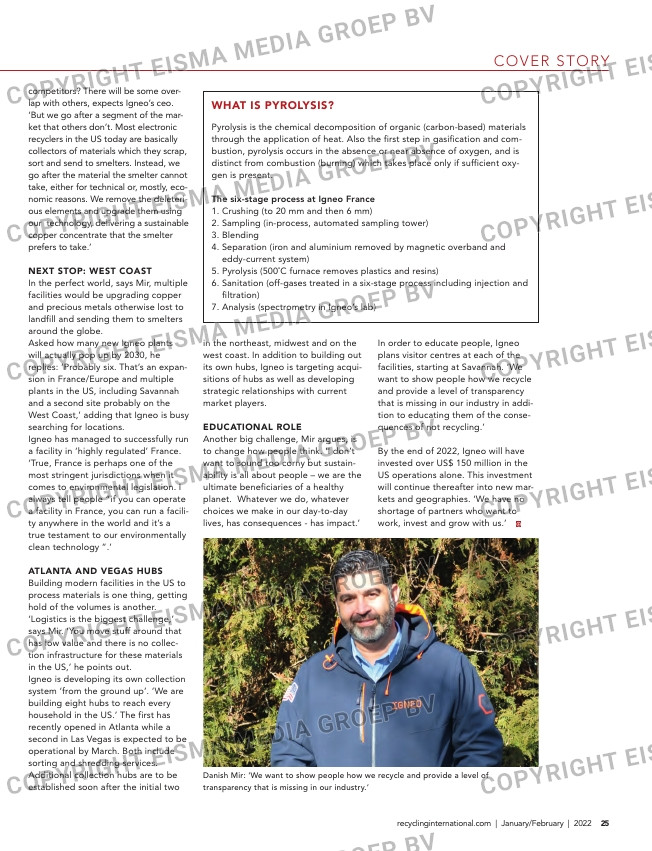

Danish Mir: ‘We want to show people how we recycle and provide a level of

transparency that is missing in our industry.’

COVER STORY

22-23-24-25_igneo.indd 25 01-02-2022 10:26