Page 49 from: December 2007

ernmental subsidies but results

from low production and operating

costs in China. It claims these ex-

ports have filled a gap in the market

and are in the interest of European

steel consumers. Chinese production

is expected to surpass 500 million

tonnes in 2008 after another annual

increase of 10%. If this happens,

China’s annual crude steel produc-

tion will have risen more than 100

million tonnes since 2006.

European steel consumers in, for

example, the automobile, construc-

tion and packaging sectors contend

that steel consumption in the region

is greater than production so Euro-

pean consumers’ interests for lower

steel prices should prevail.

Conclusion

All scrap markets are registering

strong activity but, despite strong de-

mand, exporters do not appear to be

in a hurry for new sales. At the time

of writing, very few exporters have

put forward offers for January 2008

shipment, with the exception of: a

40 000-tonne cargo from the USA

comprising 32 000 tonnes of HMS 1

and 80/20 scrap as well as 8000

tonnes of shredded scrap at an aver-

age price of US$ 365 per tonne; and a

35 000-tonne cargo from Belgium

made up of 25 000 tonnes of HMS 1

and 2 in addition to 10 000 tonnes of

shredded scrap at an average price of

US$ 352 per tonne. Both consign-

ments are for Turkey.

The main reason behind the lack

of sales activity is that exporters are

worried about ever-increasing freight

rates and have therefore become

more cautious. The freight rates ap-

plied to sales concluded in recent

weeks have gobbled up any increase

in fob prices.

With the long holiday period fast

approaching, the historical trend has

been for scrap prices to increase dur-

ing the winter months. Steel mills

and stockists would be expected to re-

turn from their holidays and set

about replenishing their inventories,

thereby pushing up scrap prices.

However, scrap prices in the first

quarter of next year will depend on

developments in the long product

market, the value of the US dollar

and ever-increasing energy prices.

M A R K E T A N A L Y S I S

Recycling International • December 2007 49

170

180

190

200

210

220

230

240

250

260

270

280

290

300

310

320

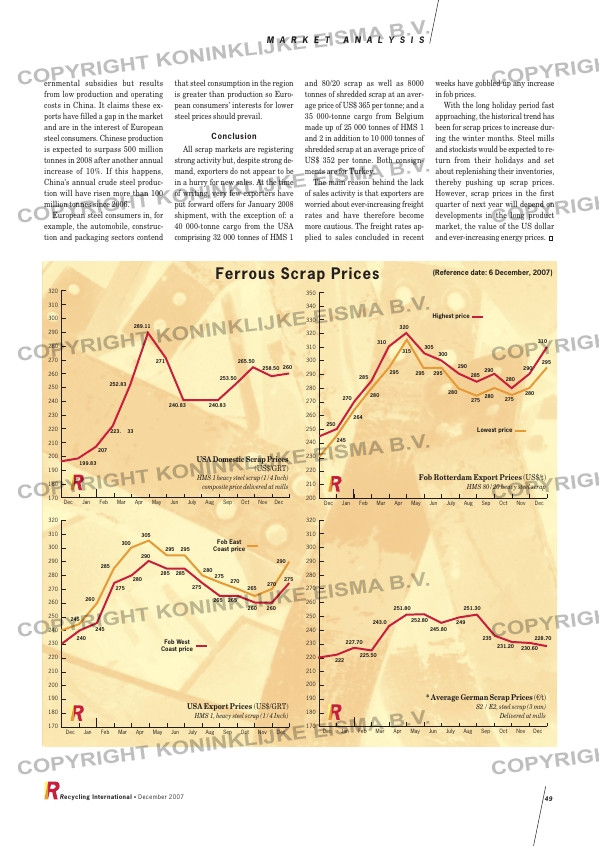

MayAprMarJan Feb JulyJun OctSepDec DecNovAug

199.83

207

223. 33

252.83

289.11

271

240.83 240.83

253.50

265.50

258.50 260

Fob West

Coast price

Fob East

Coast price

270

280

290

300

310

320

170

180

190

200

210

220

230

240

250

260

MayAprMarJan Feb Jun July OctSepDec DecNovAug

240

245

260

285

300

305

295

285

295

280

275

270

270

290

265

260 260

275

275

265 265

285

290

280

275

245

200

210

220

230

240

250

260

270

280

290

300

310

320

Highest price

Lowest price

330

340

350

MayAprMarJan Feb Jun July OctSepDec DecNovAug

245

270

285

310

320

305

300

290 290

310

285

280

275

290

280

280

295

275

280

295 295

315

295

280

264

250

170

180

190

200

210

220

230

240

250

260

270

280

290

300

310

320

MayAprMarJan Feb Jun July Aug OctSepDec DecNov

222

227.70

225.50

243.0

251.80

252.80

245.80

249

251.30

235

231.20 230.60

228.70

USA Export Prices (US$/GRT)

HMS 1, heavy steel scrap (1/4 Inch)

Fob Rotterdam Export Prices (US$/t)

HMS 80/20 heavy steel scrap

* Average German Scrap Prices (€/t)

S2 / E2, steel scrap (3 mm)

Delivered at mills

USA Domestic Scrap Prices

(US$/GRT)

HMS 1 heavy steel scrap (1/4 Inch)

com pos ite price deliv ered at mills

Ferrous Scrap Prices (Reference date: 6 December, 2007)

RI_025 MA Ferrous:MA Ferrous 06-12-2007 16:49 Pagina 49