Page 79 from: March 2013

79March 2013

Ferrous

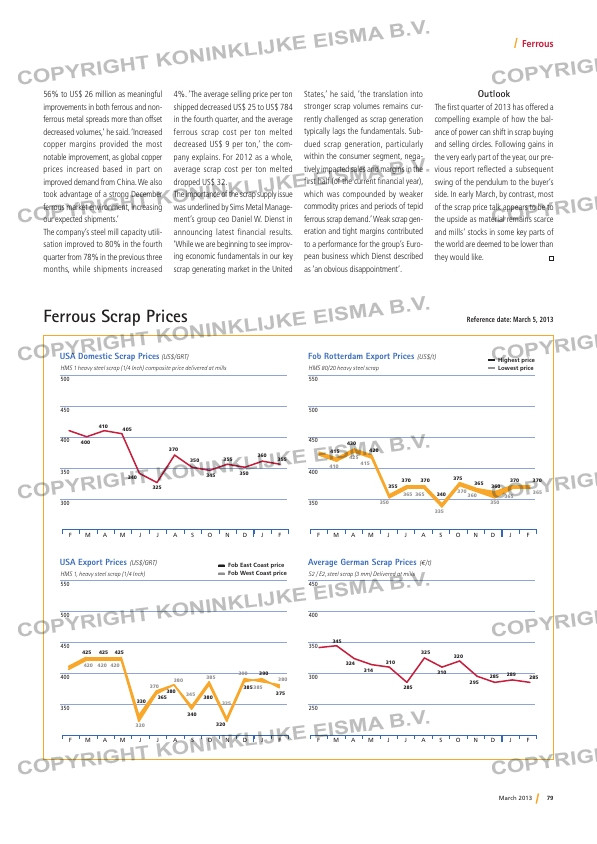

Ferrous Scrap Prices Reference date: March 5, 2013

F M A M J J A S O N D J F F M A M J J A S O N D J F

F M A M J J A S O N D J F F M A M J J A S O N D J F

HMS 1 heavy steel scrap (1/4 Inch) composite price delivered at mills

USA Domestic Scrap Prices (US$/GRT)

HMS 80/20 heavy steel scrap

Fob Rotterdam Export Prices (US$/t)

400

450

500

550

350

350

400

450

500

300

HMS 1, heavy steel scrap (1/4 Inch)

USA Export Prices (US$/GRT)

400

450

500

550

350

S2 / E2, steel scrap (3 mm) Delivered at mills

Average German Scrap Prices (e/t)

300

350

400

450

250

345

324

314

310

285

325

310

320

295

285 289 285

420

425 425 425

420 420

320

370

330

365

380

380

345

340

385

325

380

320

385

390390

385

410

400

405

340

325

370

350

345

355

350

360

355

410

425

415

430

415

350

365

420

355

365

335

370

340

370

375

360

365

350

360

370

365

370

365

375

380

370

– Fob East Coast price

– Fob West Coast price

– Highest price

– Lowest price

56% to US$ 26 million as meaningful

improvements in both ferrous and non-

ferrous metal spreads more than offset

decreased volumes,’ he said. ‘Increased

copper margins provided the most

notable improvement, as global copper

prices increased based in part on

improved demand from China. We also

took advantage of a strong December

ferrous market environment, increasing

our expected shipments.’

The company’s steel mill capacity utili-

sation improved to 80% in the fourth

quarter from 78% in the previous three

months, while shipments increased

4%. ‘The average selling price per ton

shipped decreased US$ 25 to US$ 784

in the fourth quarter, and the average

ferrous scrap cost per ton melted

decreased US$ 9 per ton,’ the com-

pany explains. For 2012 as a whole,

average scrap cost per ton melted

dropped US$ 32.

The importance of the scrap supply issue

was underlined by Sims Metal Manage-

ment’s group ceo Daniel W. Dienst in

announcing latest financial results.

‘While we are beginning to see improv-

ing economic fundamentals in our key

scrap generating market in the United

States,’ he said, ‘the translation into

stronger scrap volumes remains cur-

rently challenged as scrap generation

typically lags the fundamentals. Sub-

dued scrap generation, particularly

within the consumer segment, nega-

tively impacted sales and margins in the

first half (of the current financial year),

which was compounded by weaker

commodity prices and periods of tepid

ferrous scrap demand.’ Weak scrap gen-

eration and tight margins contributed

to a performance for the group’s Euro-

pean business which Dienst described

as ‘an obvious disappointment’.

Outlook

The first quarter of 2013 has offered a

compelling example of how the bal-

ance of power can shift in scrap buying

and selling circles. Following gains in

the very early part of the year, our pre-

vious report reflected a subsequent

swing of the pendulum to the buyer’s

side. In early March, by contrast, most

of the scrap price talk appears to be to

the upside as material remains scarce

and mills’ stocks in some key parts of

the world are deemed to be lower than

they would like.

RI_2-MA-Ferrous.indd 79 06-03-13 09:30