Page 65 from: March 2014

65March 2014

Non-Ferrous

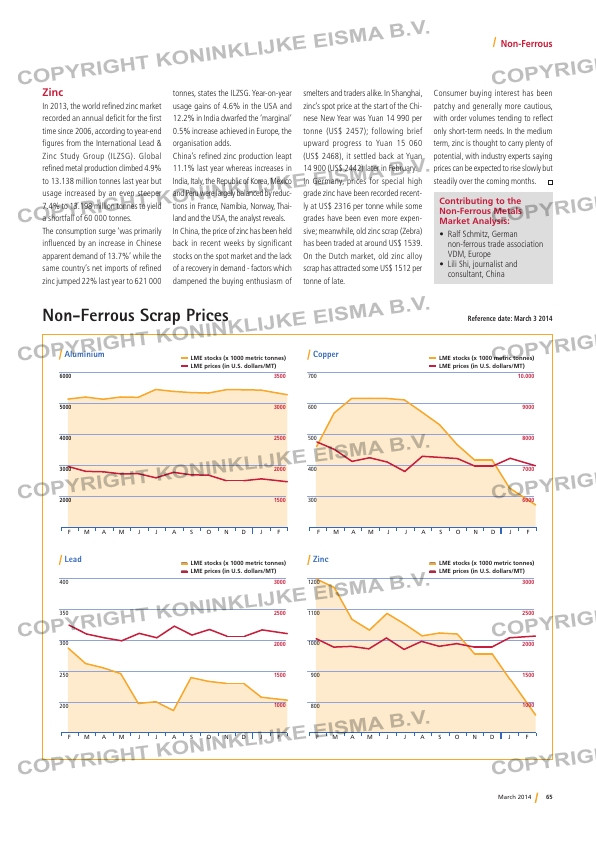

Non-Ferrous Scrap Prices Reference date: March 3 2014

Zinc

In 2013, the world refined zinc market

recorded an annual deficit for the first

time since 2006, according to year-end

figures from the International Lead &

Zinc Study Group (ILZSG). Global

refined metal production climbed 4.9%

to 13.138 million tonnes last year but

usage increased by an even steeper

7.4% to 13.198 million tonnes to yield

a shortfall of 60 000 tonnes.

The consumption surge ‘was primarily

influenced by an increase in Chinese

apparent demand of 13.7%’ while the

same country’s net imports of refined

zinc jumped 22% last year to 621 000

tonnes, states the ILZSG. Year-on-year

usage gains of 4.6% in the USA and

12.2% in India dwarfed the ‘marginal’

0.5% increase achieved in Europe, the

organisation adds.

China’s refined zinc production leapt

11.1% last year whereas increases in

India, Italy, the Republic of Korea, Mexico

and Peru were largely balanced by reduc-

tions in France, Namibia, Norway, Thai-

land and the USA, the analyst reveals.

In China, the price of zinc has been held

back in recent weeks by significant

stocks on the spot market and the lack

of a recovery in demand – factors which

dampened the buying enthusiasm of

smelters and traders alike. In Shanghai,

zinc’s spot price at the start of the Chi-

nese New Year was Yuan 14 990 per

tonne (US$ 2457); following brief

upward progress to Yuan 15 060

(US$ 2468), it settled back at Yuan

14 900 (US$ 2442) later in February.

In Germany, prices for special high

grade zinc have been recorded recent-

ly at US$ 2316 per tonne while some

grades have been even more expen-

sive; meanwhile, old zinc scrap (Zebra)

has been traded at around US$ 1539.

On the Dutch market, old zinc alloy

scrap has attracted some US$ 1512 per

tonne of late.

Consumer buying interest has been

patchy and generally more cautious,

with order volumes tending to reflect

only short-term needs. In the medium

term, zinc is thought to carry plenty of

potential, with industry experts saying

prices can be expected to rise slowly but

steadily over the coming months.

– LME stocks (x 1000 metric tonnes)

– LME prices (in U.S. dollars/MT)

– LME stocks (x 1000 metric tonnes)

– LME prices (in U.S. dollars/MT)

– LME stocks (x 1000 metric tonnes)

– LME prices (in U.S. dollars/MT)

– LME stocks (x 1000 metric tonnes)

– LME prices (in U.S. dollars/MT)

Aluminium Copper

Lead Zinc

F M A M J J A S O N D J F F M A M J J A S O N D J F

F M A M J J A S O N D J F F M A M J J A S O N D J F

250

300

350

400

1500

1000

2000

2500

3000

200

900

1000

1100

1200

1500

1000

2000

2500

3000

800

3000

4000

5000

6000

2000

400

500

600

700

7000

6000

8000

9000

10.000

300

2000

1500

2500

3000

3500

Contributing to the

Non-Ferrous Metals

Market Analysis:

• Ralf Schmitz, German

non-ferrous trade association

VDM, Europe

• Lili Shi, journalist and

consultant, China

RI-2-2014-MA Non-Ferrous.indd 65 05-03-14 15:49