The global Li-ion market will be worth over US$ 400 billion by 2035, according to new data from IDTechEx.

The lithium-ion (Li-ion) battery industry is witnessing a big shift in material usage, driven by the growing demand for electric vehicles (EVs) and stationary battery storage applications. Despite some short-term concerns over EV adoption, the long-term outlook for Li-ion battery demand remains positive.

Factors for growth include;

- improving battery technology

- more favourable prices

- increasing renewable penetration

- broadly supportive policies

Shift to different chemistries

As the EV industry moves beyond early adopters and into the mass market, the focus needs to shift toward affordability. Lithium iron phosphate (LFP) has emerged as an attractive option for EV batteries due to its lower cost compared to nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminium (NCA) chemistries.

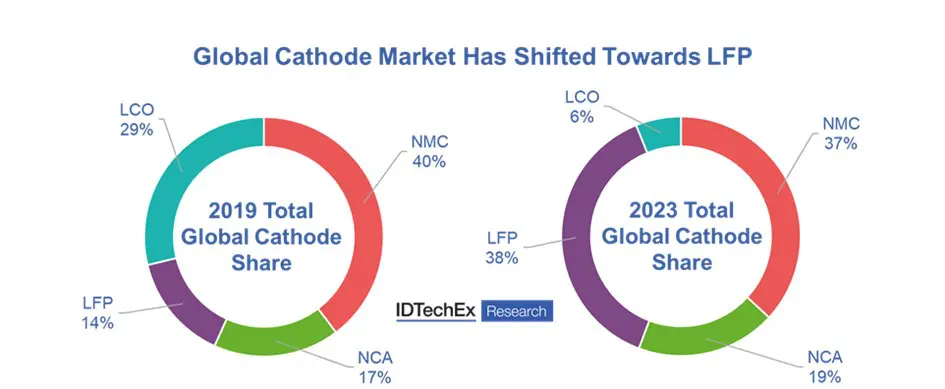

The global LFP cathode market share has increased from 14% in 2019 to 38% in 2023, according to IDTechEx. Carmakers beyond China, including Hyundai, Volkswagen, Renault, Stellantis and Ford, are planning for more LFP.

‘LFP’s share in the global battery market has been steadily rising, largely driven by China’s re-adoption of LFP cathodes for EVs,’ says Dr Alex Holland, research director at IDTechEx. ‘The influence of LFP is now spreading beyond China, with early adoption in Europe and the US.’

Holland observes that lithium manganese iron phosphate (LMFP) is another option winning ground. It retains the cost advantages of LFP while improving energy density through the inclusion of manganese in the cathode composition.

Artificial graphite gains

Another notable shift in battery material trends is that artificial graphite is gaining ground over natural graphite. IDTechEx estimates that artificial made up approximately 73% of the Li-ion battery graphite anode market in 2023, up from approximately 60% in 2020.

The primary driver behind this shift is cost. Historically, artificial graphite has been more expensive than natural due to the energy required to make it. However, low energy prices in China and extensive competition have driven down the price of artificial graphite.

Recently, prices for high-quality anodes were as low as US$ 6 per kg.

Don't hesitate to contact us to share your input and ideas. Subscribe to the magazine or (free) newsletter.